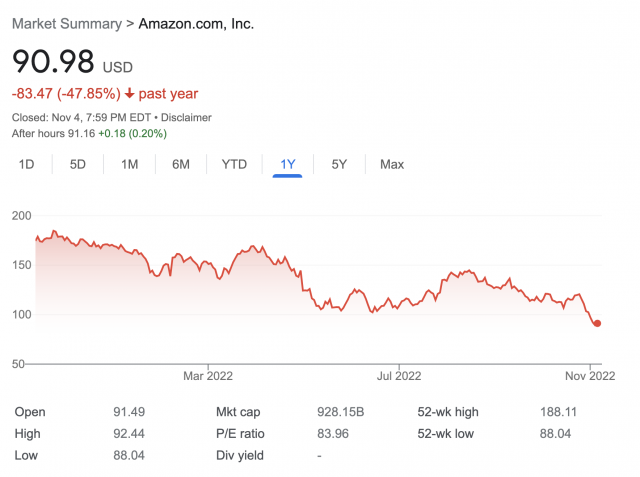

Amazon’s share price was hammered as third quarter 2022 earnings came in. It’s not looking good in terms of Amazon profits and rising costs. What does it mean for FBA and FBM sellers? Here are some of my thoughts.

For 3P sellers, Amazon will raise the bar for new supplier accounts and be more restrictive for certain categories, particularly low-cost/low-margin/non-branded items. We’ve already seen this for used books – last week, many Amazon used book sellers report their accounts were basically shut down without warning.

For 3P sellers, Amazon will raise the bar for new supplier accounts and be more restrictive for certain categories, particularly low-cost/low-margin/non-branded items. We’ve already seen this for used books – last week, many Amazon used book sellers report their accounts were basically shut down without warning.

Amazon will push hard on new paid services targeting 1P (first party) and 3P (third party) sellers to raise Amazon profits, either within existing areas of the business (Advertising, Fulfillment) or something new. Often, freebies are dangled to boost interest and then big fees are levied. This has occurred with Amazon Vine (reviews) and Amazon Transparency. More recently, Brand Stories and Premium A+ content seem to be following this pattern.

In terms of reducing operating costs, increasing integration and incentives for customers to use Whole Foods, lockers, and partnerships instead of Prime Delivery. Maybe pushing harder on merchant-fulfilled orders as well, particularly while warehouse labor remains tight.